Step-by-Step Refine for Successful Offshore Company Formation

The development of an overseas business demands an organized approach to ensure compliance and feasibility in an affordable landscape. It starts with the mindful option of a territory, taking into consideration variables such as political security and tax obligation ramifications. Following this, comprehending the intricate legal requirements and preparing important documentation is important. This process culminates in establishing a financial connection that lines up with business purposes. Yet, many overlook the importance of recurring conformity, a critical facet that can make or damage the success of an offshore venture. What might this require for your certain situation?

Selecting the Right Territory

Choosing the proper jurisdiction is a critical action in the process of offshore firm formation (offshore company formation). The selection of jurisdiction substantially influences the operational performance, tax responsibilities, and regulatory compliance of the overseas entity. Factors such as political stability, financial setting, and the credibility of the territory need to be very carefully evaluated

First of all, take into consideration the tax obligation program; some territories offer desirable tax rates or perhaps tax obligation exceptions for offshore companies, which can improve productivity. Examine the governing structure, as some territories have extra flexible regulations that can assist in service operations while making certain conformity with global criteria.

In addition, the schedule of specialist solutions, such as lawful and accountancy assistance, is crucial for smooth procedures. Territories with a reputable facilities and a robust monetary services market can use better sources for offshore companies.

Comprehending Legal Requirements

One of the primary considerations is the option of territory, as it straight affects the governing setting. Variables such as tax obligation incentives, privacy laws, and simplicity of working needs to be very carefully evaluated. Several jurisdictions require a regional authorized agent or office, which can serve as a point of call for lawful document.

In addition, it is imperative to grasp the implications of international regulations, specifically regarding anti-money laundering (AML) and combating the financing of terrorism (CFT) Conformity with these criteria is often scrutinized by regulative bodies and monetary establishments.

Preparing Necessary Documentation

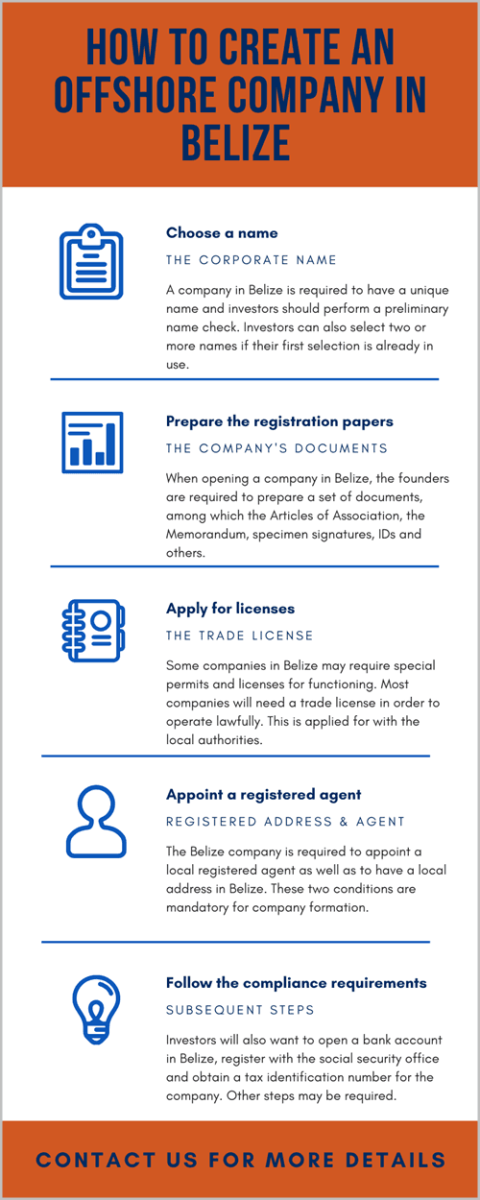

Once the legal requirements have actually been recognized, the following action in the offshore company development procedure includes preparing the required documentation. This stage is critical, as the precision and efficiency of these papers can considerably influence the success of the incorporation procedure.

Trick records commonly consist of a memorandum and short articles of association, which outline the firm's framework, function, and operational regulations. Furthermore, you will need to give evidence of identity for all directors and investors, such as tickets or national recognition cards, along with proof of home, like energy expenses or bank declarations.

Depending upon the territory, particular kinds might be called for to register the business, which should be completed carefully - offshore company formation. Some territories may also request a service strategy describing the intended operations and monetary projections of the business

It is recommended to talk to a legal professional or unification service to make sure that all files fulfill the territory's demands. Appropriate preparation not only accelerates the enrollment process yet likewise assists alleviate potential legal problems in the future. As soon as all paperwork is ready and verified, the next action in the development procedure can commence effortlessly.

Opening a Savings Account

Establishing a savings account is a vital action in the offshore business formation procedure, as it assists in economic transactions and improves the company's integrity. An overseas financial institution account gives the necessary facilities for carrying out international business, allowing for effective management of funds, receipts, and see here payments.

To open an offshore financial institution account, it is necessary to research various banking establishments to recognize those that line up with your organization demands. Variables to consider include fees, solutions supplied, account kinds, and the financial institution's credibility. As soon as you have actually selected a financial institution, prepare the required documentation, which typically includes proof of identity, evidence of address, and business documents such as the company's certificate of incorporation and memorandum of organization.

It is recommended to set up a visit with the financial institution to review your particular needs and develop a connection with the financial institution representatives. Some banks may call for a minimal deposit or cost upkeep charges, so recognizing these conditions ahead of time is essential. After the account is effectively opened, guarantee that you familiarize on your own with the on the internet financial system and offered services to efficiently handle your offshore financial resources.

Maintaining Conformity and Coverage

In the world of overseas business development, maintaining conformity and coverage is critical to making certain the long life and validity of your company operations. Failing to stick to governing requirements can cause serious penalties, including penalties and the potential dissolution of your company.

To keep compliance, it is essential to understand the details legal obligations of the jurisdiction in which your overseas entity is signed up. This commonly consists of annual filing of economic declarations, tax obligation returns, and other necessary disclosures. Staying educated concerning modifications in local laws and regulations is important, as non-compliance can arise from look at this web-site obsolete techniques.

Regularly performing interior audits can even more enhance conformity efforts. This aids determine any discrepancies in economic reporting or operational techniques before they escalate right into major concerns. Furthermore, engaging with a regional legal or economic advisor can give very useful assistance on maintaining conformity and adhering to finest practices.

Verdict

In final thought, the effective formation of an overseas company demands a methodical strategy including the option of a proper jurisdiction, understanding of lawful demands, detailed preparation of documents, establishment of an ideal bank account, and thorough maintenance of compliance with neighborhood regulations. Complying with these critical points not only boosts the likelihood of success however also guarantees the lasting sustainability of the offshore entity in a complicated international business environment.

The development of an overseas company requires a systematic method to make sure compliance and practicality in an affordable landscape.Picking the appropriate jurisdiction is an essential action in the process of a knockout post offshore company formation. The choice of jurisdiction substantially affects the functional performance, tax obligation commitments, and governing conformity of the overseas entity.Browsing the lawful needs for overseas firm development can be intricate, yet it is essential to ensure compliance with both international and local laws.To keep conformity, it is essential to understand the particular legal obligations of the territory in which your overseas entity is signed up.